Visualizing the New Era of Gold Mining

Between 2011 and 2020, the number of major gold discoveries fell by 70% relative to 2001-2010.

The lack of discoveries, alongside stagnating gold production, has cast a shadow of doubt on the future of gold supply.

This infographic sponsored by Novagold highlights the need for new gold mining projects with a focus on the company’s Donlin Gold project in Alaska.

The Current State of Gold Production

Between 2010 and 2021, gold production increased steadily until 2018, before leveling and falling.

| Year | Gold Production, tonnes | YoY % Change |

|---|---|---|

| 2010 | 2,560 | - |

| 2011 | 2,660 | 3.9% |

| 2012 | 2,690 | 1.1% |

| 2013 | 2,800 | 4.1% |

| 2014 | 2,990 | 6.8% |

| 2015 | 3,100 | 3.7% |

| 2016 | 3,110 | 0.3% |

| 2017 | 3,230 | 3.9% |

| 2018 | 3,300 | 2.2% |

| 2019 | 3,300 | 0.0% |

| 2020 | 3,030 | -8.2% |

| 2021 | 3,000 | -1.0% |

Along with a small decrease in gold production from 2020 levels, there were no new major gold discoveries in 2021. Meanwhile, annual demand for the yellow metal increased by 10%, up from 3,651 tonnes to 4,020 tonnes.

The fall in production and long-term lack of gold discoveries point towards a possible imbalance in gold supply and demand. This calls for the introduction of new gold development projects that can fill the supply-demand gap in the future.

Sustaining Supply: Gold For the Future

Jurisdictions play an important role when looking for projects that could sustain gold production well into the future.

From political stability to trustworthy legal systems, the characteristics of a jurisdiction can make or break mining projects. Amid ongoing market uncertainty, political turmoil, and resource nationalism, projects in safe jurisdictions offer a better investment opportunity for investors and mining companies.

As of 2021, seven of the top 10 mining jurisdictions for investment were located in North America, according to the Fraser Institute. Here’s a look at the top five gold-focused development projects in the region, based on measured and indicated (M&I) gold resources:

| Project | M&I Gold Resource, million ounces* | Grade (grams/tonne) | Location |

|---|---|---|---|

| KSM | 88.4Moz | 0.51g/t | British Columbia  |

| Donlin Gold** | 39.0Moz | 2.24g/t | Alaska  |

| Livengood | 13.6Moz | 0.60g/t | Alaska  |

| Côté Gold | 13.6Moz | 0.96g/t | Ontario  |

| Blackwater | 11.7Moz | 0.61g/t | British Columbia  |

*Inclusive of mineral reserves. **See cautionary statement regarding Donlin Gold’s mineral reserves and resources.

Located in Alaska, one of the world’s safest mining jurisdictions, Novagold’s Donlin Gold project has the highest average grade of gold among these major projects. For every tonne of ore, Donlin Gold offers 2.24 grams of gold, which is more than twice the global average grade of 1.03g/t.

Additionally, Donlin Gold is the second-largest gold-focused development project in the Americas, with over 39 million ounces of gold in M&I resources inclusive of reserves.

Novagold is focused on the Donlin Gold project in equal partnership with Barrick Gold. Click here to learn more now.

-

![]()

![]() Misc1 day ago

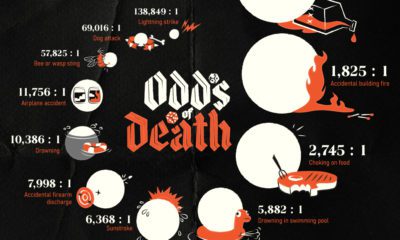

Misc1 day agoVisualizing the Odds of Dying from Various Accidents

This infographic shows you the odds of dying from a variety of accidents, including car crashes, bee stings, and more.

-

![]()

![]() Energy1 day ago

Energy1 day agoVisualizing U.S. Consumption of Fuel and Materials per Capita

Wealthy countries consume large amounts of natural resources per capita, and the U.S. is no exception. See how much is used per person.

-

![]()

![]() Economy1 day ago

Economy1 day agoThe $16 Trillion European Union Economy

This chart shows the contributors to the EU economy through a percentage-wise distribution of country-level GDP.

-

![]()

![]() VC+1 day ago

VC+1 day agoGet VC+ Before Prices Increase on February 1st

Prices for our premium memberships will be increasing on Feb 1st. Act now and get VC+ at its current rate.

-

![]()

![]() Automotive2 days ago

Automotive2 days agoThe Most Fuel Efficient Cars From 1975 to Today

This infographic lists the most fuel efficient cars over the past 46 years, including the current leader for 2023.

-

![]()

![]() Technology5 days ago

Technology5 days agoRanked: The Top 50 Most Visited Websites in the World

In this visualization, we rank the top 50 websites that receive the most internet traffic, from Google to CNN.

The post Visualizing the New Era of Gold Mining appeared first on Visual Capitalist.